The future of higher education: Transforming the students of tomorrow

Authors: Stephen Rogers, Partner at Arthur D. Little

Ben Thuriaux-Alemán, Principal at Arthur D. Little

Adina Raetzsch, Consultant at Arthur D. Little

Global higher education (HE) is a $3 trillion-per-year market that is expected to grow at 9% annually over the next five years. The traditional student-lecturer relationship is changing, and over the coming years, nine megatrends will disrupt the market and HE as we know it.

The nature of jobs is changing, and students need to be able to update their skills during their careers

Employees are changing jobs more frequently. At the same time, some of today’s jobs are under threat. HE providers can take three actions to emphasize the importance of students’ employability. First and foremost, universities should develop their students into lifelong learners with the ability to “self-reskill” and renew their knowledge bases regularly. Second, they should equip students with wider sets of skills across disciplines. In the US, such a system already exists with majors and minors, and interdisciplinarity is also increasingly common in the UK and South Korea, through “fusion majors”, for example. Third, universities should seek to update their curricula in a timely manner if new industry trends are observed. Fourth, HE providers should actively foster an entrepreneurial mindset in students to build their independence, resilience and proactiveness.

Demand for continuous education and corporate training is growing

Similarly, the rapidly changing career patterns described earlier are driving the growing importance of continuous education and corporate training. Companies are increasingly addressing their skills gaps by training existing staff. In addition, the growing frequency of job and career changes is driving up demand for short practical courses. Part of this demand will be satisfied through e-learning, which is particularly prominent, and blended learning.

HE faces serious capacity issues in dealing with the global increase in student numbers

Population growth will be a key challenge for the HE sector. By 2035, 520 million students are expected to be enrolled in higher education worldwide, growing more than five-fold from around 100 million in 2000. To put it into context, the OECD Education Director mentioned that China is constructing one university per week to address increased demand, and other sources also highlight the need for universities to be constructed at a rapid rate to support growth in HE demand.

Competition to attract the best students is increasing

Attracting the best students is important because of university branding and image, and as many universities strive to be the best, one key component of this is the caliber of their students. However, attracting the best students is increasingly difficult.

Student mobility is rising – the number of international students is expected to grow from 4.5 million to around 7.5 million by 2025. Universities are now competing on a regional and often even global scale to attract the best students. Students often select what country they wish to study in before choosing the institution. In addition, a number of newer players across the globe are using completely new approaches and gaining wide international recognition, increasing competition with existing traditional players.

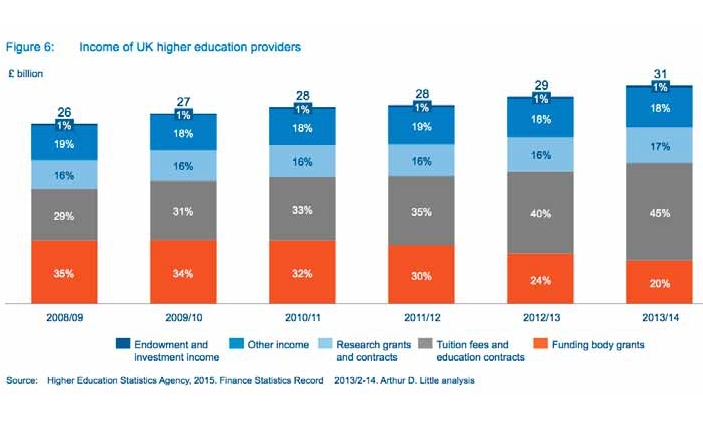

Public funding is decreasing as a share of revenue

Public funding for universities is declining, in general, while costs are rising – in both absolute and relative terms. Revenue through tuition fees is increasing, driven by both increased student fees and higher student numbers. However, this will not be enough to cover the steep decline in public funding.

This has induced some universities to turn to innovative funding models, such as the public private partnership model (PPP), to leverage private funds to finance one-off projects or ongoing programs. In 2015, education was the most active sector in terms of PPPs in Europe by number of deals, and the third largest in value terms. PPPs hold multiple advantages for universities, enabling faster development through easier access to (non-debt) capital, as well as opportunities to improve ties to industry.

Research funding is increasingly skewed towards the top universities

The HE institutions with the “best” research quality are receiving a growing proportion of research funding, while others increasingly lose out with both public and industry funding. Research strength, aside from attracting more funding, also builds international recognition and prestige, which has many collateral benefits, such as attracting top teaching staff, other top researchers, and the brightest students.

Digitalized learning environments are becoming the norm

Students increasingly expect strong digital infrastructure, and this is becoming a larger part of their learning and university experience. This trend manifests itself in a number of ways.

First, the “basics” of high-speed internet on campus, along with an online platform on which students can check grades and obtain and submit assignments, will soon be the norm. All reading materials will be digitalized, which already represents around 35% of UK publishing revenues, for example.

Second, the future learning experience will be considerably enriched by digital devices, such as OLED32-based foldable lightweight displays for note taking and multi-touch LED screens for support in class group exercises.

Third, virtual experiments and field trips through augmented reality will become widespread. As part of the former, students can undertake experiments in a safe environment and at a low cost, although virtual experiments are unlikely to fully replace the need for “real” experiments.

Fourth, robots will increasingly support both lecturers and students. While it is unlikely that robots will fully replace lecturers, a wide uptake of robots as teaching support is nonetheless expected, as prices decrease and as robots become more socially acceptable.

Blended learning is becoming the main way of learning

The blended learning/smart education market, i.e. a mix of traditional learning methods with digital learning methods and technology, is expected to grow by almost 25% per year, reaching $447 billion by 2020, and include education products, applications, and learning modes.

As part of blended learning approaches, students increasingly build their knowledge outside the traditional lecture-theater and seminar-room environment, e.g. through online research and exercises. Lecture theaters and seminar rooms are, in fact, becoming a place to work together and discuss concepts and ideas with peers, and to get guidance from the faculty.

One such increasingly common learning method is often referred to as a “flipped classroom”. This approach is sometimes combined with gamification concepts. Massive open online courses (MOOCs) are also increasingly used in blended learning, as some HE providers are starting to integrate MOOCs with physical exams and certificates. MOOCs were only introduced in 2011 but have since experienced strong growth, with around 4,000 MOOCs now being offered.

Collaborations between universities are growing, but increasingly selective

The number of research and teaching collaborations will continue to grow. One-third of all academic research is now conducted jointly through international collaborations. Teaching collaborations are also growing, comprising exchange semesters, dual degrees and partnerships on branch campuses. The main motivations for setting up such additional teaching collaborations are to broaden the education offerings, enhance the international profile and visibility, and strengthen research collaborations.

Conclusions

The global HE landscape is changing rapidly as a result of the nine megatrends outlined in this report. The playing field is shifting due to increasingly demanding students, financial pressures and growing competition. HE providers need to act now to succeed in the rapidly changing, approximately $3 trillion p.a. global HE market or risk being left behind.

For more information please visit www.adl.com