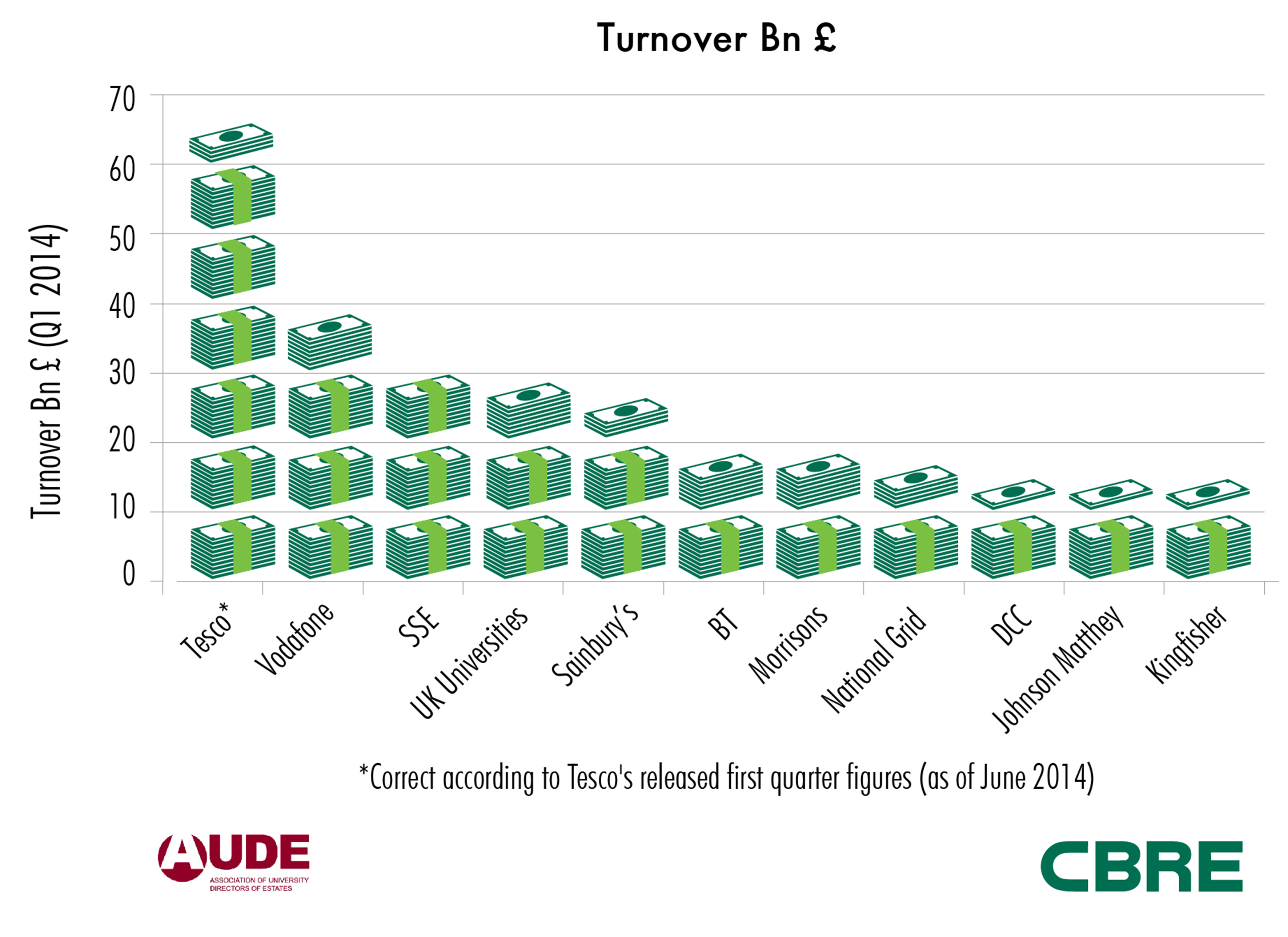

UK University Estates Turnover Hits £27 billion

- University Sector Turnover Equivalent To Fourth Largest FTSE Company

- Higher Education Capital Expenditure Greater Than Entire Crossrail Budget

- Universities Occupy 26 million m2 (280 million sq ft ) – Over 2.5 Times The Size Of The Government’s Estate (10 million m2 (107 million sq ft )

The Association of University Directors of Estate (AUDE) releases its comprehensive annual report which details the impact of University estates and facilities across the UK.

The report titled ‘Higher Education Estates Statistics Report 2014’ shows the University sector has a turnover of £27.3 billion, spends £2bn (excluding residential) per annum and occupies 26 million m2 (280 million sq ft).

Breaking this down, in comparison to FTSE listed companies the University sector would follow Tesco (£63bn*), Vodafone (£38.3bn), SSE (£30.6bn) into fourth spot with Sainsbury’s just behind with a turnover of £23.9bn. In terms of capital expenditure on University estates, excluding residential, the spend was £2bn between 2012-2013 which equates to more than the average annual Crossrail budget (£14.8bn spread across 9 years between 2009-18). In terms of size, UK universities occupy an area just shy of the NHS estate (30 million m2, 322 million sq ft) but more than two and a half times the Governments own estate (10 million m2, 107 million sq ft).

The sector has felt monumental changes over the past 5 years with tuition fees trebling in England, income declining in real terms, competition growing and any surplus income or space under significant pressure and demand. Up to 2010 the sector saw year-on-year increases in income - greater than inflation but now copes with the fact that its income has not been as fast growing with ever increasing costs. The report also reveals the substantial investment made into estates - £2bn in 2012/13 - with such funding increasingly coming from internal University sources rather than from the Government.

Energy and emissions is another key focus of the report and with these costs expected to continue to rise, the sector is at the forefront for carbon reduction strategies. At present, this is yet to materialise into reduced energy consumption, however, it holds the increase in consumption to a manageable level as buildings become ever more complex.

Excellent work has been done across the sector to date and a theme of continuous improvement is apparent. The annual report highlights some of the key trends to date, examples of which include:

• University estates and facilities are accessed by 2.4 million members of the British population

• Investment, excluding residential, in the academic estate has risen by £170m or 9% from 2011-12

• The size of the estate remains stable with older buildings demolished and new buildings producing more balanced space

• Total property costs slightly reducing, despite significant upward pressure on the increasing cost of energy and other factors outside the control of Universities

• Improved income per m2

• A reduction in space with efficiencies being introduced and greater utilisation

• Overall carbon emissions remaining stable, showing the previous upward trend has been halted, and reducing when calculated by FTE

• Functional suitability and condition of buildings improving and the age of the estate getting younger

• Increased residential capital expenditure

Andrew Burgess AUDE Chairman and Deputy Chief Operating Officer of Loughborough University, said:

”The EMS report once again shows the magnitude of what the HE Estates sector produces annually, in terms of the work it delivers, the scale it covers and the people it provides for. This report undoubtedly shows that good-quality estates management translates into a better staff and student experience which, in a climate of increased tuition fees, less income and added competition, is more valuable than ever. The University Estates sector is often taken for granted but through demonstrating that its annual turnover is larger than 346 of the FTSE 350 top revenues, I hope that people will appreciate the size, quality and impact of HE estates to both local and the UK economy.”

Sir Ian Diamond, Principal and Vice-Chancellor of the University of Aberdeen, said:

“The HE sector has undergone Copernican changes in recent years as the effects of budget cuts, tuition fees and soaring energy prices pile pressure onto a body already providing so much for so many. This report shines a light on exemplary practice and should be mandatory reading for anybody facing cuts and similar changes. The University estate is, quite literally, the building blocks of our nation’s academia and future and should be supported and celebrated at every opportunity.”

The report which was completed by every UK-wide institution creates a robust and complete picture for the entire sector. The report has been written, for the second consecutive year by CBRE, the global experts in commercial real estate services.

George Griffith, from CBRE who was involved in authoring the report said:

“The size and complexity of the University estate is something that is a constant source of surprise to the wider public, and those in the property industry. Few people realise that the estate is almost as large as the NHS or the resources that go into its management and ongoing development. It is clear University estates management underpins our future generations’ development with the sector contributing substantially to the public purse in the process. This data will become a benchmark to analyse how continuous improvements can be made now and going forward.”

*correct according to Tesco’s released first quarter figures (as of June 2014)